Contents:

Using charts, technical analysts seek to identify price patterns and market trends in financial markets and attempt to exploit those patterns. Learn how to read stock charts and analyze trading chart patterns, including spotting trends, identifying support and resistance, and recognizing market reversals and breakout patterns. On top of charts and patterns, technicians use various technical indicators – mathematical calculations that show trade entry or exit signals considering price movements and market sentiment – usually overlaid on top of charts. Used by finance professionals, technical analysis looks at past market data to make predictions about future performance. Analysts use these indicators to make sense of price movements, predict timelines, and understand market volatility. In the financial markets, technical analysis is the study of behavioral economics, risk management and trends, all of which can be applied to trading.

Technical analysis maintains that all fundamental information is already reflected in the market price, but that other variables, such as market sentiment, can influence pricing. For example, in financial markets, specific patterns in investors’ trading behavior may start to repeat over time; technical analysis can help account for these factors and thus predict future price movements. Methods vary greatly, and different technical analysts can sometimes make contradictory predictions from the same data. Many investors claim that they experience positive returns, but academic appraisals often find that it has little predictive power. Of 95 modern studies, 56 concluded that technical analysis had positive results, although data-snooping bias and other problems make the analysis difficult. Nonlinear prediction using neural networks occasionally produces statistically significant prediction results.

Pick a Strategy or Develop a Trading System

Price data (or as John Murphy calls it, “market action”) refers to any combination of the open, high, low, close, volume, or open interest for a given security over a specific timeframe. The timeframe can be based on intraday (1-minute, 5-minutes, 10-minutes, 15-minutes, 30-minutes, or hourly), daily, weekly, or monthly price data and last a few hours or many years. Charles Dow, an American financial journalist behind the Dow Theory, formulated a basis for technical analysis. His editorials included discussions about two basic assumptions, a framework for technical analysis. Firstly, all markets are efficient, but even random price fluctuations can be identified through historical patterns and trends that tend to repeat in the future. Traders use technical charts to assess a stock or index’s strengths and weaknesses, price action, trends, and volume.

- Stock moving averages can be calculated across a wide range of intervals, making them applicable to both long and short-term investment strategies.

- The average price of an asset over a specific period is useful as it can help the trader to identify support and resistance levels.

- Risk capital is money that can be lost without jeopardizing ones financial security or life style.

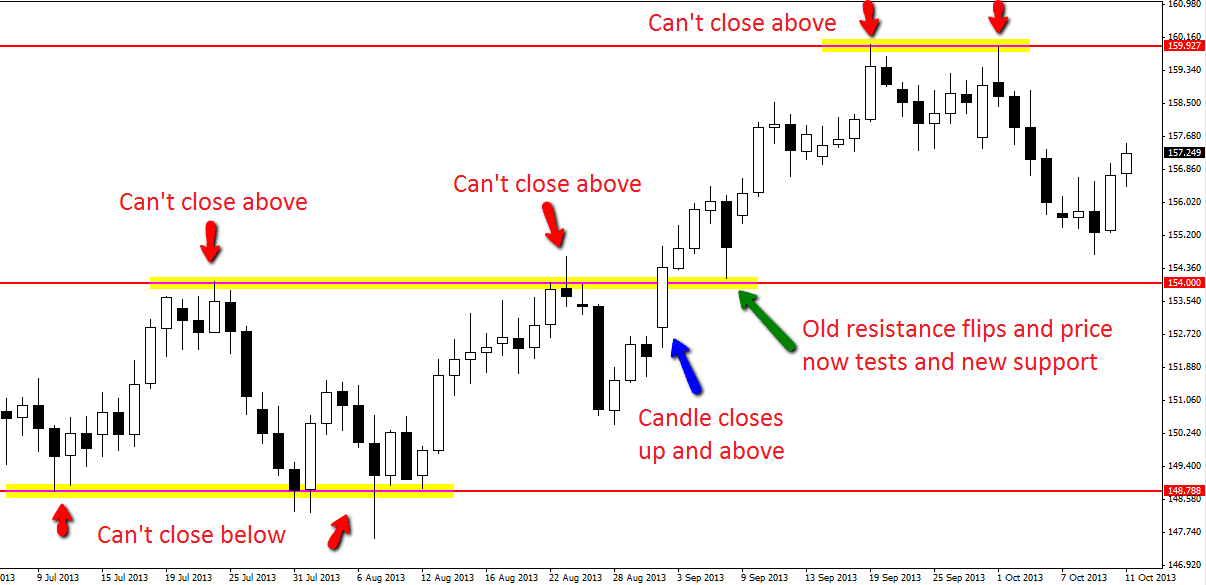

- Support and resistance indicators are a crucial aspect of technical analysis and refer to price levels when market prices struggle to cross a level and break through.

- For example, an investor may find an undervalued stock in a downtrend and use technical analysis to identify a specific entry point when the stock could be bottoming out.

The best way to test this theory is to examine the chart and ask how many times the stock hit these support and resistance levels? The more frequently the price of an asset falls to support and rises or rises to resistance and falls, the more reliable the conclusion that there is support and resistance at these levels. The time frame a trader selects to study is typically determined by that individual trader’s personal trading style. Intra-day traders, traders who open and close trading positions within a single trading day, favor analyzing price movement on shorter time frame charts, such as the 5-minute or 15-minute charts.

Technical analysis time frames

But in fact, the CMT Association’s website has a treasure trove of learning resources. If you’re looking to start forex trading, you should start from the beginning and go through the entire course. School of Pipsology is a free online course that’s perfect for anyone interested in trading forex.

No recommended for beginners, requires learning and understanding to implement profitably. On most charts, if the horizontal left line is lower than a horizontal line on the right, then the bar will be shaded green, representing a growth period. If you’re an experienced trader look for new trading ideas, the CMT website has much to offer. On the website, you will find the key findings of each chart pattern including rules and backtesting results. Many online trading courses promise spectacular results and use high-pressure sales tactics, but then fail to deliver the promised results. Gordon Scott has been an active investor and technical analyst or 20+ years.

Are mathematical calculations – and even sometimes as simple as a trendline – that allow traders to identify when an asset might have reached its peak or has bottomed out. It uses historic price, volume and open interest information to forecast what direction the financial market which is being analysed is going. This underlying knowledge can help a trader identify trading opportunities. Pivot and Fibonacci levels are worth tracking even if you don’t personally use them as indicators in your own trading strategy. Some traders use white and black candlestick bodies ; other traders may choose to use green and red, or blue and yellow. Whatever colors are chosen, they provide an easy way to determine at a glance whether price closed higher or lower at the end of a given time period.

Technical Analysis – A Beginner’s Guide

It shows Apple’s current stock price ($156 per share) as well as the movement of the day (4.11% down or $6.70). Learning new concepts about trading approaches and the stock market is critical to your success as a trader. Low float stocks are a type of stock with a limited number of shares available for trading, which tends to cause… This entire post has been focused around technical analysis, but there is still value to fundamental analysis. It wouldn’t be feasible to apply fundamental analysis to every trade, but it’s important to be aware of some fundamentals.

This moving average details that over the last 50 days the average price has been $99. As a result, it indicates that there is a lot of support at 99$ per share and that the share price will likely bounce once it hits this level as investors attempt to buy it for what they consider to be an average price. Many market commentators make the case that fundamental and technical analysis are these two competing schools of thought, but this is a foolish belief. The truth is that technical and fundamental analysis are simply two sides of the same coin.

Introduction to technical analysis

Technical analysis is a method of analysing the market, focusing on trends in prices and trading volume. It helps traders identify areas where there may be potential opportunities for profit or risk reduction, as well as warning signs to avoid. Finding the right combination is different for every trader, so it’s important to start with the basics and work your way into using the indicators and patterns that make the most sense to you. Because momentum indicators generally only signal strong or weak price movement, but not trend direction, they are often combined with other technical analysis indicators as part of an overall trading strategy. By measuring the strength of price movement, momentum indicators help investors determine whether current price movement more likely represents relatively insignificant, range-bound trading or an actual, significant trend. Because momentum indicators measure trend strength, they can serve as early warning signals that a trend is coming to an end.

John Murphy states that the principal sources of information available to technicians are price, volume and open interest. Other data, such as indicators and sentiment analysis, are considered secondary. Milan Cutkovic has over eight years of experience in trading and market analysis across forex, indices, commodities, and stocks.

Generally, the larger a best way to learn technical analysis is, the more docile its stock moves are. This is because larger companies would require significantly more shares to be bought or sold in order to move their stock price. It is entirely possible for a 500 million dollar market cap company to increase 100% in value over a trading day with very positive news. It would be next to impossible for companies as large as Apple to make such a drastic move. However, the way they interpret these data points may differ from trader to trader.

Stock analysts attempt to determine the future activity of an instrument, sector, or market. Beginners should first understand why technical analysis works as a window into market psychology to identify opportunities to profit. Technical analysis, or using charts to identify trading signals and price patterns, may seem overwhelming or esoteric at first. It’s important to determine whether or not a security meets these three requirements before applying technical analysis. That’s not to say that analysis of any stock whose price is influenced by one of these outside forces is useless, but it will affect the accuracy of that analysis.

How technical analysis can help you make smarter cryptocurrency trades – BusinessWorld Online

How technical analysis can help you make smarter cryptocurrency trades.

Posted: Thu, 13 Apr 2023 09:45:45 GMT [source]

This theorem is similar to the strong and semi-strong forms of market efficiency. Technical analysts believe that the current price fully reflects all information. Because all information is already reflected in the price, it represents the fair value, and should form the basis for analysis. It would be folly to disagree with the price set by such an impressive array of people with impeccable credentials. Technical analysis utilizes the information captured by the price to interpret what the market is saying with the purpose of forming a view of the future. Technical analysis has to do with forecasting future financial price movements based on past price movements.

This system fell into disuse with the advent of electronic information panels in the late 60’s, and later computers, which allow for the easy preparation of charts. Applying Kahneman and Tversky’s prospect theory to price movements, Paul V. Azzopardi provided a possible explanation why fear makes prices fall sharply while greed pushes up prices gradually. This commonly observed behaviour of securities prices is sharply at odds with random walk.

For example, if a security has been trading in a strong, sustained uptrend for several months, but then one or more momentum indicators signals the trend steadily losing strength, it may be time to think about taking profits. Technical analysis is a tool, or method, used to predict the probable future price movement of a security – such as a stock or currency pair – based on market data. It helps traders and investors navigate the gap between intrinsic value and market price by leveraging techniques like statistical analysis and behavioral economics. Technical analysis helps guide traders to what is most likely to happen given past information. Most investors use both technical and fundamental analysis to make decisions.

To know volatile periods, traders can use volatility indicators, which help to reveal periods of high and low volatility of a particular stock’s assets or the whole market. It is one of the best online references for practitioners of technical analysis. You can find clear explanations of various chart types and indicators here. Learn how to trade and analyze financial markets using technical analysis with these high-quality websites which are chocked full of articles and tutorials.

Learn with ETMarkets: Dow Theory – the cornerstone of technical analysis – Economic Times

Learn with ETMarkets: Dow Theory – the cornerstone of technical analysis.

Posted: Sun, 09 Apr 2023 05:28:00 GMT [source]

While traditional backtesting was done by hand, this was usually only performed on human-selected stocks, and was thus prone to prior knowledge in stock selection. With the advent of computers, backtesting can be performed on entire exchanges over decades of historic data in very short amounts of time. Fundamental analysts examine earnings, dividends, assets, quality, ratios, new products, research and the like. Technicians employ many methods, tools and techniques as well, one of which is the use of charts.

The more of these questions you can answer positively, the bigger the chance to have found the best way to https://trading-market.org/ technical analysis. If a stock you thought was great for the last 2 years has traded flat for those two years, it would appear that Wall Street has a different opinion. If a stock has already advanced significantly, it may be prudent to wait for a pullback. Or, if the stock is trending lower, it might pay to wait for buying interest and a trend reversal. Technical analysis cannot predict extreme events, such as a change in management, regulatory changes, and geopolitical events.

Moving averages are probably the single most widely-used technical indicator. A simple moving average trading strategy might be something like, “Buy as long as price remains above the 50-period exponential moving average ; Sell as long as price remains below the 50 EMA”. Using technical analysis you can easily find the general trend of the market (Up Trend/Down Trend/Range Bound). You can use the Nifty Yearly/Monthly/Weekly chart to find out the same.