Forex Trading Category

6月 1st, 2021 by eo in Forex Trading

You will find several positive reviews by desertcart customers on portals like Trustpilot, etc. The website uses an HTTPS system to safeguard all customers and protect financial details and transactions done online. The company uses the latest upgraded technologies and software systems to ensure a fair and safe shopping experience for all customers. Your details are highly secure and guarded by the company using encryption and other latest softwares and technologies.

.jpeg)

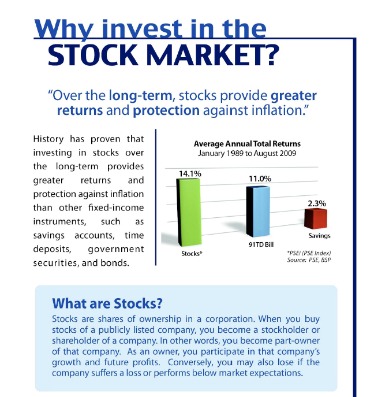

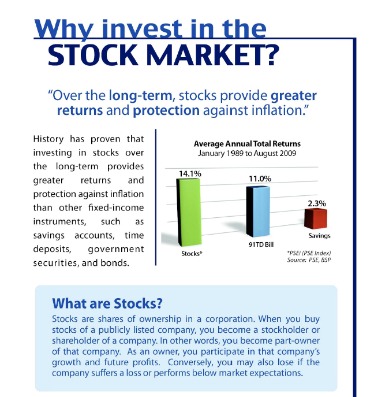

Generally, retailers like to make stock available at certain times. The time when new Xbox Series X stock is most likely to be made available is at midnight ET, on certain days. There are multiple Xbox Series X fan groups that keep users up to date on where the latest restocks are happening. Research shows stocks with tickers that are actual English words enjoy advantages like lower spreads and greater liquidity. But crucially, they’re also more popular with less-sophisticated investors.

Unfortunately, there are no Xbox Series X deals to report on at the moment. Demand for Microsoft’s console is so high — and supply so low — that retailers simply have no incentive to offer Xbox Series X deals. In fact, we don’t expect to see any Xbox Series X deals till the next major retail holiday — Prime Day. And when Xbox Series X deals do show up, we expect the sales to come in the form of bundles and freebies rather than dollar-off discounts.

Rivian valued at over $100 billion on listing after biggest IPO of 2021

Target Corp’s first-quarter profit fell by half and the company warned of a bigger margin hit on rising fuel and freight costs. Its shares fell about 25%, losing about $25 billion in market capitalization, in their worst session since the Black Monday crash on Oct. 19, 1987. Desertcart provides a seamless and secure shopping platform with 100 million+ products from around the globe delivered to your door.

- We can deliver the Shin Megami Tensei V Standard Edition Nintendo Switch speedily without the hassle of shipping, customs or duties.

- Since 2014, desertcart has been delivering a wide range of products to customers and fulfilling their desires.

- And when Xbox Series X deals do show up, we expect the sales to come in the form of bundles and freebies rather than dollar-off discounts.

- There are multiple Xbox Series X fan groups that keep users up to date on where the latest restocks are happening.

It’s also not a bad idea to make an account on Slickdeals and set a deal alert for “Xbox Series X.” Recibirás una alerta por correo electrónico cuando se cree un nuevo hilo sobre el stock reabastecido. But we’ve found that sometimes Slickdeals doesn’t email users fast enough. So it might be better to type in “Xbox Series X” in the search bar and sort by new. ET, for when customers wake up, while others will aim at midday to give everyone the best chance of finding a new Xbox Series X console. The handle is known for updating users on the latest deals and restocks faster than anyone else on the platform.

Xbox Series X restock — avoid the scalpers

The youth accounts are available to teens whose parents or guardians – who can monitor the accounts – are Fidelity customers. Large institutional investors and funds have traditionally been the first in line for allocations on IPOs, as well as the investment banks that earn big money from arranging such offerings. The S&P 500 ended lower on Friday after data showed weaker jobs growth than expected in September, yet investors still expected the Federal Reserve to begin tapering asset purchases this year. Wall Street’s three main indexes were mixed for much of the session before losing ground toward the end.

When autocomplete results are available use up and down arrows to review and enter to select. Touch device users, explore by touch or with swipe gestures. Explore the expansive world of post-apocalyptic fibo group review Tokyo, fully rendered in stunning 3D utilizing Unreal Engine 4, a first for the mainline Shin Megami Tensei series. Click here to go to economictimes.com Site will load in seconds.

Desertcart ships the Shin Megami Tensei V Standard Edition Nintendo Switch to and more cities in India. Get unlimited free shipping in 164+ countries with desertcart Plus membership. We can deliver the Shin Megami Tensei V Standard Edition Nintendo Switch speedily without the hassle of shipping, customs or duties. As frustrating as it can be to find an Xbox Series X or Series S, we suggest you avoid buying a console from these scalpers. Paying massively over the odds for a console that doesn’t have a huge range of new Xbox Series X games isn’t a shrewd move in our opinion.

Xbox Series S at Newegg

Unfold an allusive story filled with tragic choices, make sacrifices to uphold your ideals as you pursue light or covet darkness to discover your role in the new world. Another set of retailers to keep an eye on are subscription-based wholesalers like Costco, Sam’s Club, and BJ’s Wholesale Club. Because it requires a paid account to get access to these wholesalers, there are often fewer people jumping GCI Forex Broker Review over each other to find a unit. If you don’t have a subscription to any of these retailers, ask a few friends or family members. The products will be exclusively available at Nykaa’s online and offline stores across the country. Monsoon CreditTech is a fintech company catering to large financial services companies, including Banks, NBFCs (Non-Banking Financial Companies), HFCs and fintech firms.

The online brokerage startup is rolling out in phases its investing platform, Robinhood IPO Access, for users of its trading app, a step in its quest to “democratise” finance. A similar phenomenon took place in January, when GameStop at one point surged more than 1,600%. Shares of the video-game retailer also rallied alongside AMC in the past week. The two companies are among a handful of shares dubbed meme stocks that are enjoying rapid, social-media fueled gains.

It’s a potential game-changer now the retail crowd is driving as much as a quarter of U.S. equity trading volume, and a behavioral quirk that’s especially important for funds. Slickdeals, the online deal repository, has a forum thread dedicated to ordering an Xbox Series X through Microsoft. The thread is constantly being updated, so jump to the last page and click refresh for the latest intel on when units will become available.

Wall St posts 4th straight gain, Meta earnings rattle social media after hours

If you can hold out, Microsoft should have more Xbox Series X units to ship, as well as the promise of more exclusive games for the console. Unfortunately, wholesalers tend to bundle new consoles with either extra games or accessories. PopFindr is a site that checks local retail inventories based on your zip code. For example, you can check local Target stores in your area to see if any Xbox Series X’s are available. Do note, that just because it shows in stock, it might be out of stock by the time you arrive at the store.

Xbox Series X en Amazon

The Nasdaq has tumbled almost 19% from its record-high close on Nov. 19, nearing a 20% decline that many investors view as the definition of a bear market. To raise cash, SoftBank has exited fxcm broker companies including Uber Technologies and home-selling platform Opendoor Technologies, for a total gain of $5.6 billion. These ebooks can only be redeemed by recipients in the India.

Desertcart is the best online shopping platform where you can buy Shin Megami Tensei V Standard Edition Nintendo Switch from renowned brand. Desertcart delivers the most unique and largest selection of products from across the world especially from the US, UK and India at best prices and the fastest delivery time. Yes, it is absolutely safe to buy Shin Megami Tensei V Standard Edition Nintendo Switch from desertcart, which is a 100% legitimate site operating in 164 countries. Since 2014, desertcart has been delivering a wide range of products to customers and fulfilling their desires.

» »

5月 3rd, 2021 by eo in Forex Trading

You must avoid day trading scammers with Lambo’s on TikTok and knuckle down to reading serious trading books and taking professional trading courses from industry professionals. If you prefer to watch rather than read, my guide to stock trading with help you through the entire process of learning stock market trading with every high-quality free and low-cost resource available. Having the proper mindset and knowing how to overcome the emotions of trading will be one of the most important lessons to learn. Learning technical analysis and candlesticks is very important as well but that comes second to knowing how to control your emotions when trading. We teach you the fundamental skills on how to do this between our free stock market courses for beginners, trade rooms, live streams, and within our community.

The https://topforexnews.org/age’s risk management system automatically designates account holders as PDT if they do a certain kind of trading. The course is suitable for all levels of stock market investors and traders. UpSkillist also gives you a certificate after successful completion of the course. Hence, if you are trying to get a job as a stock market trader in brokerage agencies, you can also leverage the certificate there. Shaw Academy has been one of the market leaders in professional online learning courses on finance, technology, photography, business analytics, etc.

It is a great way to earn money sitting at home by just investing a few hours of the day. The stock market is not just all about profit but there is a risk where you might suffer losses. There has been a question which remains in everyone’s mind that how many traders and investor might be earning good profit in the stock market even after knowing the real fact of risk.

Best Budget Course: Bullish Bears

Books provide a wealth of information and are inexpensive compared to the costs of classes, seminars, and educational DVDs sold across the web. One of my personal favorites is How to Make Money in Stocks by William O’Neil , founder of CANSLIM trading. When you buy 100 shares of stock, someone is selling 100 shares to you. Similarly, when you go to sell your shares of stock, someone has to buy them.

The platform also offers individual coaching from teachers and mentors as well—making it an excellent choice for both new traders who are looking for a little more hand-holding. The idea behind Eagle is that you get alerts that can spur growth in your portfolio. Even though this isn’t a course, you can teach yourself how to trade, learn from the best and continue learning with every new alert. Ezekiel Chew the founder at Asia Forex Mentor isn’t your typical trainer.

Scanners will save you an incredible amount of time of doing lots of research. Again, start off with free scanners then work your way up to scanners like Trade Ideas or Black Box Stocks when you have the budget available. The commodities sector is a very popular trading and investing sector. Some of the most popular commodities are gold and silver, oil, energy, and natural gas. Commodities and commodity futures are very popular among both traders and investors.Click here to see a list of the most popular companies in the different sectors.

Free Investing Course for Beginners

A real-time trading simulator is available as an add-on and the Pro package comes with expert mentoring. Not entirely sure online stock trading is for you, but want to learn more? A low-cost option from Udemy or the no-cost option available at TD Ameritrade is your best choice. The first week will introduce some common vocabulary and discuss how bonds are valued. In the next week, you’ll look at real market data to understand how bonds are priced, and you’ll submit your first assignment. In the following two weeks, you’ll go through the same process with stocks, learning how stocks affect company operations and submitting a final assignment.

- Plus, there are dedicated chapters for candlestick patterns and candlestick analysis.

- In addition, some brokers support fractional share trading for beginners, so even if you don’t have enough to buy a full share, you can buy a portion that fits your investing budget.

- You’re competing against people who know what they’re doing because they do it day in and day out for a job.

- If you need to back up a couple steps, here’s an article on how to learn about stocks.

- Basic math knowledge is helpful for stock trading, but understanding how financial news, macroeconomics, and sentiment affect stock markets is more beneficial.

Making your first trade – Get our best stocks to buy now list, and learn to read stock quotes and use the right order types. Learners get introduced to the intraday technical indicators and charts, such as candlestick. Plus, there are dedicated chapters for candlestick patterns and candlestick analysis.

This course is highly relevant for the beginner or newer investor who wants to learn all the key practical aspects when investing in stocks as they will become an expert by the end of the course. Those who are already familiar with investing in stocks and want to upgrade their skills might also want to learn from this course. This course has received loads of appreciation from the students. Over 75,000 students have completed training from this course and with 21,000 outstanding reviews, this course tops the list of 8 best Stock trading courses to learn in 2020. All the educational and training content of this platform is available through various flexible subscription options. As you increase your experience, you can upgrade to Basic and then to the Elite package.

Can you make $1,000 a day trading stocks?

However, you can save a lot of your money by subscribing to one of the two membership packages with different offers. Our Level 2 course strategies are built upon the crucial skills taught at Level 1, so it is vital that every trader knows the Level 1 concepts fully. In fact, a critical error newbie traders make is to over-risk their position or over-trade. Then the insights in this course will help you find the gap in your trading plan and help you make that vital strategy tweak to start seeing consistent profits.

The 12-hour course is a comprehensive, step-by-step roadmap for new traders to learn the basics and then build upon that knowledge. By the end of the course, you will know several effective, reliable, and profitable trading strategies you can use on your own. You’ll also have access to a community of traders who you can share ideas with and ask questions. Bear Bull Traders offers a learning platform that is as extensive as you’ll find. It also has very reasonable prices, making it the best value day trading course.

Commodity trading is a risky venture as prices of any commodity are regulated by market supply and demand, which can be affected both positively and negatively by political disturbances. Both courses provide learners with deep insight into the futures trading segment. Then, the learner can eventually make the shift to advanced courses. The advanced courses are available in textual, video as well as audio form. This again looks easier on paper than what really happens in real life.

We https://en.forexbrokerslist.site/ how to “trade” stocks, options and futures in ourtrading room. That means, we teach support and resistance, charting, order entry and implementation, the psychology behind trading, and also provide a community of support for help along the trading journey. Our live streams are the best way to learn stock trading because it’s real time, and you can ask questions, and see what we are thinking and the WHY behind trading. The best day trading courses offer a number of student support tools, from tools to contact the professor to an online forum where students can congregate and share information.

If you are a newbie in the stock trading ecosystem, you should go through some of the best day trading courses before entering the market. We know scouring the internet for reliable day trading learning resources could be hectic. Hence, we give you some top-notch training courses you can take and invest in. Carefully read the course description before you sign up and make sure that it’s what you’re looking for.

Rich https://forex-trend.net/ invest in stocks, bonds, fine art, fine wine, and real estate. Most importantly, rich people buy businesses and invest in people because those people make them richer through the power of leverage. You need capital to make profits despite what social media influencers tell you.

The best day trading courses not only give you learning material, but they also provide communities and leadership to help you learn how to be successful. These courses are top notch, and they’ve got the price tag to prove it. It will cost you an extra $1,000 to gain access to these 3 stock trading courses, on top of your membership fee. In fact, many brokerages offer free online libraries to customers, allowing you to teach yourself a range of topics at no cost at all. You can sign up for interactive courses for as low as $49, or spend $4,000 or more on your investing education. Paying for a course can be worth it if the material and strategies you learn help you improve your returns and build a stronger financial future.

» »

5月 3rd, 2021 by eo in Forex Trading

A great deal of forex trade exists to accommodate speculation on the direction of currency values. Traders profit from the price movement of a particular pair of currencies. The amount of margin required by most retail forex brokers in contrast is negligible. Other features include customized converters, a currency encyclopedia, travel expense calculator, and forex currency news.

In this example, a profit of $25 can be made quite quickly considering the trader only needs $500 or $250 of trading capital . The flip side is that the trader could lose the capital just as quickly. Rollover can affect a trading decision, especially if the trade could be held for the long term. Large differences in interest rates can result in significant credits or debits each day, which can greatly enhance or erode profits of the trade. A pip is the smallest price increment tabulated by currency markets to establish the price of a currency pair.

Forex refers to the global electronic marketplace for trading international currencies and currency derivatives. Most of the trading is done through banks, brokers, and financial institutions. In the past, forex trading was largely limited to governments, large companies, and hedge funds.

Because of this, most retail brokers will automatically “roll over” their currency positions at 5 p.m. This is obviously exchanging money on a larger scale than going to a bank to exchange $500 to take on a trip. For example, you can trade seven micro lots or three mini lots , or 75 standard lots .

Apodos de pares de divisas de Forex

The business day excludes Saturdays, Sundays, and legal holidays in either currency of the traded pair. During the Christmas and Easter season, some spot trades can take as long as six days to settle. Funds are forex volatility calculator exchanged on the settlement date, not the transaction date. Some of these trades occur because financial institutions, companies, or individuals have a business need to exchange one currency for another.

Brokers generally roll over their positions at the end of each day. Formerly limited to governments and financial institutions, individuals can now directly buy and sell currencies on forex. It expanded the number of products that could be traded from just forex to include stocks and commodities. A summary of the day’s forex and stock market figures will be given afterwards.

As an example, trading in foreign exchange markets averaged $6.6 trillion per day in 2019, according to the Bank for International Settlements . The portal served forex trading community to offer free currency conversion tools, tables of historical data, news, and market analysis. Overnight positions refer to open trades that have not been liquidated by the end of the normal trading day and are often found in currency markets.

Specialties include general financial planning, career development, lending, retirement, tax preparation, and credit. Gordon Scott has been an active investor and technical analyst of securities, futures, forex, and penny stocks for 20+ years. He is a member of the Investopedia Financial Review Board and the co-author of Investing to Win. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

What is Forex (FX)?

The broker will rollover the position, resulting in a credit or debit based on the interest rate differential between the Eurozone and the U.S. If the Eurozone has an interest rate of 4% and the U.S. has an interest rate of 3%, the trader owns the higher interest rate currency in this example. If the EUR interest rate was lower than the USD rate, the trader would be debited at rollover. This means investors aren’t held to as strict standards or regulations as those in the stock, futures oroptionsmarkets. There are noclearinghousesand no central bodies that oversee the entire forex market. You can short-sell at any time because in forex you aren’t ever actually shorting; if you sell one currency you are buying another.

A spot market deal is for immediate delivery, which is defined as two business days for most currency pairs. The major exception is the purchase review broker binary.com or sale of USD/CAD, which is settled in one business day. The forex market is unique for several reasons, the main one being its size.

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy.

Any forex transaction that settles for a date later than spot is considered a forward. The price is calculated by adjusting the spot rate to account for the difference in interest rates between the two currencies. The largest foreign exchange markets are located in major global financial centers including London, New York, Singapore, Tokyo, Frankfurt, Hong Kong, and Sydney. In the forex market, currencies trade in lots called micro, mini, and standard lots. A micro lot is 1,000 units of a given currency, a mini lot is 10,000, and a standard lot is 100,000.

These represent the U.S. dollar versus the Canadian dollar , the Euro versus the USD, and the USD versus the Japanese Yen . The forex market, despite its vast size, can be vulnerable to periods of illiquidity. Forex exists so that large amounts of one currency can be exchanged for the equivalent value in another currency at the current market rate. Amanda Bellucco-Chatham is an editor, writer, and fact-checker with years of experience researching personal finance topics.

Many investment firms, banks, and retail brokers allow individuals to open accounts and trade currencies. The trade carries on and the trader doesn’t need to deliver or settle the transaction. When the trade is closed the trader realizes a profit or loss based on the original transaction price and the price at which the trade was closed. The rollover credits or debits could either add to this gain or detract from it. Retail traders don’t typically want to take delivery of the currencies they buy. They are only interested in profiting on the difference between their transaction prices.

Forex e o mercado mundial na atualidade[editar | editar código-fonte]

For example, an American company may trade U.S. dollars for Japanese yen in order to pay for merchandise that has been ordered from Japan and is payable in yen. This is done through forex brokers who act as a mediator between a pool of traders and also between themselves and banks. Prior to the development of forex trading platforms in late 1990s forex trading was restricted to large financial institutions. Currency prices move constantly, so the trader may decide to hold the position overnight.

There are some major differences between the way the forex operates and other markets such as the U.S. stock market operate. A forex or currency futures contract is an agreement between two parties to deliver a set amount of currency at a set date, called the expiry, in the future. Futures contracts are traded on an exchange for set values of currency and with set expiry dates.

- A summary of the day’s forex and stock market figures will be given afterwards.

- This is obviously exchanging money on a larger scale than going to a bank to exchange $500 to take on a trip.

- This means that you can buy or sell currencies at virtually any hour.

- Others make money by charging a commission, which fluctuates based on the amount of currency traded.

- Investopedia requires writers to use primary sources to support their work.

- Specialties include general financial planning, career development, lending, retirement, tax preparation, and credit.

A profit is made on the difference between the prices the contract was bought and sold at. The forward points reflect only the interest rate differential between two markets. They are not a forecast of how the spot market will trade at a date in the future. The euro is the most actively traded counter currency, followed by the Japanese yen, British pound, and Swiss franc. Currencies being traded are listed in pairs, such as USD/CAD, EUR/USD, or USD/JPY.

Forex Lots

The central bank attempted to contain the rate of the zloty’s appreciation by intervening in the forex market within the band. The foreign exchange, or Forex, is a decentralized marketplace for the trading of the world’s currencies. Most speculators don’t hold futures contracts until expiration, as that would require they deliver/settle the currency the contract represents. Instead, speculators buy and sell the contracts prior to expiration, realizing their profits or losses on their transactions.

Because the market is open 24 hours a day, you can trade at any time of day. The exception is weekends, or when no global financial center is open due to a holiday. Unlike a forward, the terms of a futures contract are non-negotiable.

In addition, the company offers online sub prime financial services, such as money lending, forex trading, and advanced electronic funds management. Since the market is unregulated, fees and commissions vary widely among brokers. Most forex brokers make money by marking up the spread on currency pairs. Others make money by charging a commission, which fluctuates based on the amount of currency traded. When trading in the forex market, you’re buying or selling the currency of a particular country, relative to another currency. But there’s no physical exchange of money from one party to another as at a foreign exchange kiosk.

If you sell a currency, you are buying another, and if you buy a currency you are selling another. The profit is made on the difference between your transaction prices. The forex market is open 24 hours a day, five days a week, in major financial centers across the globe. This means that you can buy or sell currencies at virtually any hour. Cory is an expert on stock, forex and futures price action trading strategies. A spot exchange rate is the rate for a foreign exchange transaction for immediate delivery.

Investopedia does not include all offers available in the marketplace. Well, government can make a directive, but if there is no forex nothing will be done. oanda autochartist Assume a trader believes that the EUR will appreciate against the USD. Another way of thinking of it is that the USD will fall relative to the EUR.

» »

4月 30th, 2021 by eo in Forex Trading

Unia przetrwała aż do lat dwudziestych XX wieku i dopiero po jej rozwiązaniu frank stał się jedyną walutą obowiązującą w Szwajcarii. Co w pewnym stopniu ostatnio niespotykane, swoją siłę pokazuje frank szwajcarski. Widać to przede wszystkim po tym, że deprecjacja waluty Helwetów zatrzymała się mniej więcej w połowie poprzedniego ruchu w górę. Obecna konsolidacja znajduje się piętro wyżej od tej z początku listopada i wiele wskazuje, że za szybko nie wrócimy do tamtych poziomów.

Według danych na rok 2014 znacznie większe zadłużenie we franku mieli Austriacy. Franki szwajcarskie, jako jedyne na świecie, emitowane są w formie banknotów, które ogląda się w pionie, a nie w poziomie. Kurs franka na wykresie jest prezentowany dla celów orientacyjnych, w oparciu o przybliżone dane i nie ma charakteru transakcyjnego tzn. Nie stanowi ze strony serwisu elementu oferty ani propozycji zawarcia transakcji. Wykres USDCHF wskazuje, że możemy mieć do czynienia z budującą się wciąż falą 4. W związku z tym będę czekał z pozycjami wskazanymi na wykresie na dołączenie się do wzrostów.

Kurs Frank (frank szwajcarski) / PLN (polski płoty)

Dzięki brokerom online możeszkupować i sprzedawać franka szwajcarskiego bezpośrednio w internecie i na żywych wykresach, bez konieczności fizycznego posiadania waluty. Jest to świetny sposób na wykorzystanie zmian kursów, aby zarobić pieniądze samemu podejmując decyzje inwestycyjne czy postawić nawzrost czy na spadek cen franka. Zmienność wyniosła niecały cent a eurodolara poruszał się wokół poziomu 1,040 przez większość dnia.

- Monety o mniejszych nominałach przedstawiają Libertas – rzymską boginię wolności.

- Kontrolę nad emisją franka sprawuje Szwajcarski Bank Narodowy .

- Powyższy wykres prezentuje kurs EUR/CHF na rynku forex, z dokładnością do czterech miejsc po przecinku.

- Chodziło o postawę Szwajcarów, którzy w tamtym okresie skupowali złoto od III Rzeszy, co bardzo nie spodobało się innym państwom.

- W dzisiejszym artykule znajdziesz krótkie podsumowanie dotyczące zmian kursów walut w ciągu ostatnich 10 dni.

Kurs CHF/PLN to cena franka szwajcarskiego podana w polskich złotych. W przypadku pary walutowej CHF/PLN, frank szwajcarski jest walutą bazową, a polski złoty walutą kwotowaną. Wykres prezentuje kurs, który aktualizowany jest od poniedziałku do piątku. Notowania pochodzą z rynku Forex i podawane są do czwartego miejsca po przecinku. Uwaga – powyższy kurs może różnić się od kursu podawanego w danym momencie przez kantory lub Narodowy Bank Polski. Chociaż Szwajcaria nie jest czołową gospodarką świata, to jej waluta – frank szwajcarski – od lat jest jedną z najważniejszych walut świata.

Wejście na podstawie przecięcia Tenkan-Sen i Kijun Sen z wyliczonymi momentami dotarcia do TP. Na wykresie dniowym Tenkan Sen jest nad Kijun Sen co skłoniło mnie do zaproponowania pozycji długiej, ale i tak uważam, że to ryzykowne… Wykres Tygodniowy KUMO, SSB , TS i KS płaskie sugeruje ruch boczny Cena weszła w interakcję z KUMO i SSB ale ponownie wyszła dołem. Jeżeli chodzi o kwestie bezpieczeństwa, to zachęcamy do korzystania z renomowanych usług brokerskich. Posiadanie stosownych certyfikatów jest gwarantem tego, że twoje środki inwestycyjne będą odpowiednio zabezpieczone, a metody działania brokera są w pełni zgodne z obowiązującym prawem. Do połowy XIX wieku w Szwajcarii każdy kanton, każda gmina, a nawet klasztory mogły wybijać własne monety.

Notowania dolara amerykańskiego do korony szwedzkiej w sobotę, listopada. Zwiększona zmienność na rynku walut!

Pozwoliło jej to na stanie się bankową mekką o legendarnej wręcz renomie (choć ta została nieco zachwiana w ostatnich latach). Frank szwajcarski obowiązuje na terenie Szwajcarii i Liechtensteinu. Przez lata frank był jedną z najbardziej stabilnych walut. W Polsce kurs franka szwajcarskiego jest Prognoza ekonomiczna dla 7 września-Forex szczególnie obserwowany przez osoby, które mają kredyt hipoteczny w tej walucie. Na parze CHF/PLN ponownie zbiegły się nam dwie historie. Z jednej strony mocniejszy złoty, który starał się kierować kurs franka na południe, ale nie wychodziło mu to tak dobrze, jak w przypadku poprzednich par.

Dopiero w 1848 roku powstała Szwajcarska Konstytucja Federalna, w myśl której prawo do bicia monet – franków miał wyłącznie Rząd Federalny. Kurs franka może zmieniać się w zależności od napięć krajowych i międzynarodowych, czy nawet przez katastrofy ekologiczne, na które przecież nikt z nas nie ma żadnego wpływu. Frank szwajcarski jest owocem dobrze rozwiniętego szwajcarskiego systemu bankowego, który dał podwaliny pod globalną gospodarkę państwa, zwłaszcza w czasach wojen i niepokojów społecznych.

Wypowiedzi A.Glapińskiego pozostawały zgodne z oczekiwaniami rynkowymi zakładającymi dalsze zacieśnianie polityki pieniężnej i przyczyniły się jedynie do niewielkiego umocnienia po .. RPP kontynuowała w grudniu proces zacieśnienia polityki pieniężnej (podwyżka o 50pb.). Wykrystalizowało się również postrzeganie celu Rady – RPP celuje w średni okres (wcześniej pojawiały się sugestie o możliwej reakcji na odchylenia bieżącej inflacji od projekcji). W środę rano widać na szerokim rynku kontynuację umocnienia dolara z wtorkowego popołudnia, chociaż dynamika ruchu słabnie. Przypomnijmy – pretekstem do odbicia USD była wyższa dynamika produkcji przemysłowej za wrzesień, która może legitymizować “jastrzębie” nastawienie FED. Na monetach frankowych (1/2 franka, 1 i 2 franki) widnieje kobieca postać – Helvetia, która jest swego rodzaju symbolem Szwajcarii.

Powodem tego było między innymi to, że do 2000 roku konstytucja gwarantowała pokrycie 40% wartości wszystkich wyemitowanych środków w wyżej wymienionym kruszcu. Frank szwajcarski według standardu ISO 4217 określany jest kodem CHF, ale można spotkać się też ze skrótami „Fr” lub „SFr”. Kurs CHF słynął ze stabilności od samego początku i, mimo kontrowersyjnych kredytów we frankach, frank do teraz uznawany jest za jedną z najbezpieczniejszych walut. Rynek krajowy – wyczekiwanie na decyzję Rady Polityki Pieniężnej uśpiło notowania złotego podczas wczorajszej sesji. Kurs EUR/PLN koncentrował się wokół poziomu 4,59 generując niewielką amplitudę zmian. Nieco odmienne były nastroje na pozostałych walutach regionu Europy Środkowo-Wschodniej.

Wyższe stopy generują wzrost ich rentowności, zachęcając inwestorów do lokowania kapitału w Szwajcarii. Pojawia się wtedy zwiększony popyt na franka szwajcarskiego i jego cena wzrasta. Frank szwajcarski CHF jest znany przede wszystkim ze swojej stabilnej wartości. Chociaż kraj szwajcarskich bankierów nie jest tak wielką potęgą przemysłową jak Stany Zjednoczone czy Japonia, jego waluta jest jedną z pięciu najważniejszych walut na świecie.

We francuskojęzycznym dialekcie wyraz balle jest używany dla potocznego określenia franka szwajcarskiego. Zasadniczo można wyróżnić ponad 100 czynników, które mają poważny wpływ na kurs złotego. Inwestorzy, którzy chcą i nauczą się wszystkich, zdobędą klucz do wahań pary CHF / PLN, a będzie to potężnym narzędziem do zyskownego skalpowania. Frank szwajcarski jest uważany za bardzo bezpieczną walutę. Z tego powodu podczas różnych turbulencji na rynku traderzy inwestują właśnie w niego, co powoduje znaczne wzmocnienie. Szwajcaria tworzy obecnie unię walutową z miniaturowym księstwem Liechtensteinu.

Zachęcamy także do korzystania z hiperłączy, które dadzą Ci dostęp do wielu innych szczegółowych danych odnośnie wartości franka. Spadek zaufania do franka wiąże się z bardzo konkretną datą. 15 stycznia 2015 roku, został przezwany przez finansistów „czarnym czwartkiem”.

Trzeba jednak pamiętać, że nadal jesteśmy na dość wysokich poziomach, ale biorąc pod uwagę sytuację na świecie, a szczególnie ciągle trwający konflikt na Ukrainie, nie można się temu dziwić. Kontrakty CFD są złożonymi instrumentami i wiążą się z dużym ryzykiem szybkiej utraty środków pieniężnych z powodu dźwigni finansowej. 77% rachunków inwestorów detalicznych odnotowuje straty pieniężne w wyniku handlu kontraktami CFD u niniejszego dostawcy.

Jednak potem nastąpiła gwałtowna korekta, która wyznaczyła nam ważne wsparcie w pobliżu 4,42 zł. Frank kolejny raz korzysta na łatce waluty uznawanej za safehaven. Ma to kluczowe znaczenie przede wszystkim ze względu na potencjalny konflikt Rosji z Ukrainą. Po pierwsze nasz złoty jest na pierwszej pośredniej linii frontu, przez co jest wyjątkowo czuły na każde doniesienie medialne w tej sprawie.

Gdzie obowiązuje frank szwajcarski?

Dla inwestorów z całego świata helwecka waluta jest jedną z „bezpiecznych przystani”, do których kapitał ucieka w momencie rynkowych zawirowań. Z polskiego punktu widzenia, franki istotne są w kontekście kredytów udzielonych na zakup mieszkań. Ich liczba sukcesywnie jednak spada, a nowych udzielanych jest niewiele. Kurs CHF/PLN jest szczególnie wrażliwy na działania Szwajcarskiego Banku Narodowego .

Robimy wszystko dla Twojej satysfakcji i sukcesu na giełdzie. Handluj na giełdzie za pośrednictwem brokera internetowego LYNX. Towary handlowe w LIVE cen surowców na giełdzie online, wykresy cenowe.

Tym bardziej że przekłada się to proporcjonalnie na raty kredytów. Frank szuka dna W środę miała miejsce pozornie nieistotna konferencja prasowa prezesa Szwajcarskiego Narodowego Banku. Pan Jordan powiedział jednak znacznie więcej, niż oczekiwano. Przez chwilę mogłem pochwalić rodzimą walutę, ale przychodzi moment, gdy trzeba spojrzeć na przypadek, przeczący tezie o jakiejś niesamowitej kondycji złotego.

Acala ( USD), Tribe (0.212391 USD) oraz Prom (4.32 USD). Sprawdzamy rynek kryptowalut. Stan na dzień 12 listopada, sobota

Inwestowanie w CHFPLN za pośrednictwem aplikacji mobilnej możesz rozpocząć za pomocą kilku kliknięć. Na kurs złotego wpływają również informacje finansowe, a szczególnie ogłoszenie stawki przez Pantheon finansów opinii. Zalety i wady Panteon Finance bank krajowy. Z drugiej strony bank podejmuje takie działania, aby utrzymać stabilny poziom inflacji. Frank przybył również do Szwajcarii w związku z wojnami, tym razem z wojnami napoleońskimi.

Wczoraj kurs EUR/PLN – po trzecim z rzędu dniu wzrostu – sięgnął poziomu 4,7070. Przecena złotego była spójna z zachowaniem się pozostałych walut regionu, w tym węgierskiego forinta. Wyczekiwanie na decyzję RPP (miało miejsce o historycznie późnej godzinie) skutkowało zaś względnym wyciszeniem zmian na krajowym rynku długu. Dochodowość 10-latki koncentrowała się wokół poziomu 7,70%, a krótkiego końca krzywej 10 pkt. Czynnikiem, który mocno wpłynął na wzrost wartości franka szwajcarskiego, był kryzys strefy euro. Wiązało się to jednak z osiągnięciem zbyt silnej pozycji wobec innych walut, co miało negatywne skutki gospodarcze.

Na miejscu trzeba jednak liczyć się z tym, że wiele małych sklepów, kiosków, straganów umożliwia płatności tylko we frankach szwajcarskich. Dlatego przy dłuższych pobytach wygodniejszym i tańszym rozwiązaniem jest posiadanie przy sobie środków w frankach szwajcarskich. Poniżej prezentujemy Państwu kurs franka szwajcarskiego na żywo na wykresie. Wykres jest dostępny on-line, 24 godziny na dobę, 7 dni w tygodniu. Wczorajsza sesji mimo, iż zdominowana była przez (wydłużone) oczekiwanie na wynik posiedzenia Rady Polityki Pieniężnej realizowana była w dużym stopniu przez wskazania techniczne. Kontynuowana była zatem przecena polskiej waluty w relacji do euro wynikająca z miesięcznego kanału spadkowego.

Wyjaśnienia można doszukiwać się w przeszłości, kiedy to wyraz stutz używany był w odniesieniu do handlu wymiennego, oznaczał również okazyjną sytuację. Symbol „CHF” zaczerpnięto od skrótu oznaczającego łacińską Spirax-Sarco Engineering powołuje Nimsha Patela na dyrektora finansowego zgodnie z planem nazwę kraju „Confoederatio Helvetica”, a „F” oznacza „frank”. Usługa TMS Stocks (przyjmowanie i przekazywanie zleceń) oferowana jest w ramach sprzedaży krzyżowej wraz z usługą TMS Connect (wykonywanie zleceń).

» »

3月 17th, 2021 by eo in Forex Trading

The MPS in a make-to-order environment is a schedule of the actual customer orders. The MPS in operations management must balance the demand identified by sales and marketing with the availability of resources. To tide over these uncertainties, there are statistical and mathematical techniques which help managers to plan the levels of safety or buffer stock. When searching for a software solution, you must ensure that these must-have features and functions of inventory management are available in that tool. It helps to free up any tied cash in inventory for most entities and reduces the direct costs.

Management of inventory or Inventory management is all about handling functions related to the tracking and management of material. Inventory management is very important in the case of Production Oriented Enterprises. Before we https://1investing.in/ understand how exactly inventory management has an impact on your business, it is essential that we walk through the levels that make up an organization. An organization is made of three levels — structure, process, and system.

Q: Which of the following is a function of inventory?

This information is tracked by retailer and is also shared with upstream vendors. Fibre2fashion.com does not endorse or recommend any article on this site or any product, service or information found within said articles. The views and opinions of the authors who have submitted articles to Fibre2fashion.com belong to them alone and do not reflect the views of Fibre2fashion.com. Forecast Data Report – Summary of historical demand activity, which indicates the margin of error between forecast and actual and provides a statistical summary. In previous articles, we introducedBills of Materials and Material Requirements Planning , two legs of the inventory planning tripod. A line fill rate is the percentage of order lines that could be filled completely.

Logistics companies are responsible for managing the surplus goods within the warehouses. It ensures that the goods are safely transported throughout the entire process starting from manufacturing to distribution. Handling goods or materials can be a daunting task, therefore the organizations should streamline the work activities and incorporate the relevant equipment which is manual, semi-automated, and automated equipment. Moving stored materials or products is an important function of logistics which can lower the manufacturing cost and elevate the customer experience.

Inventory management examples—industry use cases

When you need to get access to the software from the comfort of your home or when you are travelling, you should be able to do so without any issue. TallyPrime enables you to access all inventory-related information from your device as long as you are connected to the Internet. Whether you are using your smartphone or your tablet, you can get access to the business reports on a web browser. Constant monitoring of stock changes and analyzing the inventory data helps to maintain a strong stock pipeline and disbursement across all the sales chain.

Also, this information helps them stock up scarcely available raw materials to produce finished goods without delays. Logistics refers to the process of managing and monitoring the complex supply chain operations about how the resources are acquired, stored, and transported to the desired destination. There are various functions of logistics management that are extremely essential for the seamless movement of goods or products.

Modern, cloud-based inventory management systems provide comprehensive materials management capabilities that effectively manage the flow of goods across your company and its global supply network. In conjunction with warehouse management systems, they provide accurate and timely visibility into inventory levels, restocking plans and order fill rates, all effect customer satisfaction. Inventory turnaround is that notion that speaks to the amount of time raw materials and parts spend in the plant after purchase and before they are put to use.

When you receive an order from your customer, order management takes care of preparing a sales order and invoice. After the order confirmation, the warehouse management process will identify the location of the stock and send it to your store. Then, just like the wheels, the packaging and shipment process sets the item in motion. functions of inventory It ensures that the item gets packed, dispatched, and delivered to the customer, on time and safely. Inventory management enables each component in this process to perform its step and contribute to reaching the desired end. Effective inventory management solutions are critical as the demand-supply chains need to be balanced.

Inventory management software

The sales and operations planning processes help to attain effective inventory management. The primary aim of sales and operations planning is to bring the demand management functions together with the operations functions. The significance of inventory management in the demand-supply chain provides updated and direct sales forecasting information, which assists the sales and marketing group in planning for future inventory needs. When talking about inventory, it is vital that one of the functions of inventory management software is to be flexible to suit your business requirements.

- RFID tags can be active, continually broadcasting a signal, or passive, requiring physical readers to track items.

- Along with the BOM, MPS can determine what components are needed from manufacturing and what components need to be purchased.

- Inmake-to-stockenvironments, a limited number of items are assembled from a larger number of components, for example, video recorders or computers.

- Managing restaurant inventory is unique in that it must provide real-time ingredients monitoring because many are fresh, have short shelf lives and carefully tracked through to consumption.

Before a master production schedule can be produced, you need to create a demand plan. This uses historical data from sales to forecast customer orders over the coming months or years. The demand plan must also include a set amount of safety stock – in case an unexpectedly large order is generated – to protect against stock outs. To help achieve the demand and supply balance, businesses implement sales and operations planning (S&OP) processes. The fundamental purpose of S&OP is to bring the demand management functions of the company together with the operations functions of the company. Assemble-to-orderenvironments make use of raw materials to form basic components and complete sub assemblies.

A company moves some of its jobs to another country and employing workers in other countries to save on labor costs best describes the practice of outsourcing. Expansion is a phase in which, when the economy moves from a trough to a peak. It is a period when the level of business activity surges and gross domestic product expands until it reaches a peak.

What are the six functions of inventory?

It involves categorising inventory into three buckets called A, B and C depending upon the importance of the inventory to its profit. A category consists of expensive items, and hence a small inventory is held. While inventory management is common across most industries, there are particular industries with unique requirements that warrant specialized systems. Inventory management is complex and varies depending on your industry, your function within the company, and the type of item being managed.

Inventory management involves making trade-offs between revenue, cost, and risk. Classified on the balance sheet as a current asset, inventory consumes company cash. Careful attention must be paid to the length of the cash conversion cycle—the time between purchasing raw materials or merchandise to the final sale of finished products and receipt of payments from customers.

Results Out for BACHELOR OF MANAGEMENT STUDIES (SEM…

Therefore, embracing the latest technological innovations strengthens the business goals by significantly impacting the decisions and making the operations more cost-effective. Embracing a transportation network that responds to your organizational needs is significantly optimizing the last-mile delivery and reducing transportation costs. Therefore, it is known to be one of the major functions of logistics as it is driven by strategic planning and determines the success of the supply chain ecosystem. Retail inventory management software allow retailers to swiftly react to changes in buying behavior and adjust their channel strategies and inventory levels.

Typical data elements can include YTD totals, and total yearly demand and quarterly totals, with percentage comparisons of items and their product group total. Because of the requirements of factors of production such as power, materials, water and labor, the economical location for manufacturing is often at a considerable distance from the major market. To provide maximum supply service, consistent with maximum efficiency and optimum investment. From buying, selling, and keeping the stock organized; inventory management plays a significant role. Get thorough information and clarity about inventory management from this article. The Business Application Support functional area at SLAC provides administrative computing services to the Business Services Division and Human Resources Department.

A good inventory management system allows you to have satisfied customers because you will always have sufficient stock to meet their demand. Inventory management is also important because it makes it easy for businesses to track stocks and replenish their stocks when required. It is also important as it gives insights into trends and inventories that are most profitable for your business. Inventory control by businesses is done to ensure an adequate stock quantity. It guides entities on quality control, operational control and ensures accounting accuracy. It will help the business meet the projected demand with the least inventory holding cost and plan purchases ahead of time.

Inventory management keeps marketing goals secured by ensuring the right items are available at the right time, and it keeps your finances aligned by controlling the flow of stock. Inventory management is a technique of controlling, storing, and keeping track of your inventory items. Inventory management is an essential component of supply chain management, as it regulates all the operations that are involved from the moment an item enters your store until it has been dispatched. When you have an inventory system in place, you have a lower risk of overselling. Additionally, you know the expiry date and the manufacturing date which ensures you get rid of the stock on time because it gets expired.

Today, retailers must offer very flexible customer buying options for goods that are offered through different channels. Cycle counting is a method of checks and balances to confirm that physical inventory counts match a company’s inventory records. The periodic counting of individual items throughout the year ensures the accuracy of inventory quantities and values. OptiProERP is a leading global provider of industry-specific ERP solutions for manufacturers and distributors. Item Demand and Forecast – Presents historical data for a user-specified span of time along with the next 12 months of forecasted demand for each item.

» »

|

.jpeg)